Founder-Market Fit

At its core, founder–market fit refers to the alignment between a founder’s personal background (experience, skills, aptitude, and network) and the market problem they are solving for. It asks, “Why are you specifically the right person to solve this problem in this market?” Investors care deeply about this question. The reason is simple: products can, and often will, pivot. But a founder who knows their market inside and out, who understands their potential customers, and their pain points is in a far stronger position to build a successful company.

Why does founder-market fit matter so much, especially at early-stage? At pre-seed or seed, there may be little or no product, revenue, or traction yet. Investors are forced to bet on the founder above all else. Long before product-market fit is considered founder-market fit is a key predictor of future success. Investors ask simply: “Is this the right founder for this market?”.

Founders should demonstrate founder-market fit early (by pre-seed/seed), paving the way for product–market fit down the road. In the very earliest rounds, while the business is still being validated, the founder’s personal fit with the problem is often the clearest signal of potential.

Traditional Founder-Market Fit: What Does It Look Like?

The classic image of founder-market fit is a founder who is an industry veteran solving a problem they’ve personally experienced. For example, imagine an ex-employee of a large manufacturing company who spins out with a colleague to launch a startup addressing a pain point that plagued their industry for years. They know the problem intimately, they know the existing solutions (and why those fall short), and, perhaps most importantly, they have a Rolodex of 50+ industry contacts they can call immediately. These contacts become the first people to validate the pain point, provide early feedback, and potentially sign on as pilot customers. This founder has a head-start, and a unique, unfair advantage: they speak the industry’s language, understand the nuances of the market, and can open doors that an outsider might struggle to unlock.

Having this kind of deep domain experience brings tangible advantages:

Credibility and Insight: Founders who have lived the problem are at a much lower risk of building in a vacuum. In other words, they are less likely to create a product that may be technically impressive but lacks real customer need or willingness to pay. That firsthand, deep domain expertise leads to an ability to spot second- and third-order effects that others often miss.

Built-in Network: Industry veterans come with a ready Rolodex of customers, partners, and mentors. That access can accelerate pilots, feedback loops, and critical early validation.

Investor Confidence: When a founder deeply understands the space, investors take notice. At the early stage, in the absence of metrics, founder-market fit is the strongest signal of long-term potential and resilience. It greatly increases the likelihood that the founder will be able to raise subsequent rounds of financing.

Strong founder-market fit means you are uniquely positioned to win in your market. You have the background, insight, and contacts to solve the problem in a way others potentially can’t. Over and over again, investors will prioritize the right founder over all else at early stage.

How to Tell Your Story Without Traditional Founder-Market Fit

If you're not an industry veteran, that does not mean you cannot raise capital or build credibility. It simply means you need to be thoughtful and deliberate in how you tell your story. At pre-seed, investors are not investing in metrics. They are investing in you. Your goal is to show them that you are the right person to solve this problem, if not because of a long track record in the field, then because of the validation work you have already done and the conviction you bring to the table.

Start by explaining what led you to this problem. It might have been a personal frustration, a recurring challenge you felt, something you believed other industries were also facing due to market tailwinds such as regulation or technology shifts, an issue you encountered in a related role, or a theme that kept coming up in conversations with friends or colleagues. Investors want to understand why this problem matters and why you are willing to dedicate years of your life to solving it.

Then show your homework. Talk about the users you have spoken to, the patterns you uncovered, and how those conversations influenced your thinking. Share what surprised you or changed your assumptions. This demonstrates that you are not building on intuition alone. You are building on real insights gathered from the people who matter most - your future customers.

If you brought on a co-founder, advisor, or early team member with domain experience, highlight that. It shows self-awareness and your ability to recruit people who strengthen your perspective.

Finally, back it all up with action. If you have secured early pilots, have customers lined up, or built a waitlist, those are clear signs that you understand the market and can make real progress. Execution builds trust and often speaks louder than any resume.

Many successful founders started as outsiders. What made them stand out was not where they came from, but what they did. They earned their credibility by putting in the work, talking to customers, and learning faster than anyone else. If you do the same, your story will resonate, not in spite of your background, but because of the clarity and commitment you bring to the table.

Telling Your Founder-Market Fit Story to Investors

Whether you have a traditional founder-market fit or an earned one, how you communicate it can make all the difference in fundraising. Remember that early-stage investors are investing in you - so you need to craft a narrative that convinces them you’re destined to build this business. Here are some tips for effectively telling your story:

Connect the Dots – “Why You, Why This, Why Now”: A compelling founder story clearly links your background to the problem. Don’t assume it’s obvious - spell it out. Perhaps you noticed the problem while managing a P&L in industry, or maybe a project in your last job inspired this idea. Or, if you’re an outsider, describe the moment you became obsessed with the problem and the steps you took to dive in (the customer interviews, the research). Answering “why you,” “why this problem,” and “why now” creates a narrative that stands out. For example: “After 5 years in healthcare operations, I saw first-hand how inefficient procurement was - sometimes I literally organized vendors on paper. I knew there had to be a better way. That’s why I’m building this solution now, as hospitals face pressure to digitize.” This kind of story shows personal insight and timing.

Show Earned Secret or Insight: Investors love when a founder can say, “Everyone else thinks X, but I discovered Y.” If your experience or research revealed a non-obvious insight, highlight that. It could be a metric or anecdote from your interviews that contradicts common wisdom. For instance, “In talking with 30 CFOs, we uncovered that the real bottleneck isn’t what the industry assumes - it’s actually the manual spreadsheet consolidation, which no one had quantified before. This insight is central to our product.” Demonstrating an earned secret is proof that your alignment with the market is yielding valuable knowledge.

Highlight Relevant Credibility: You might not have 15 years in the industry, but emphasize whatever is relevant in your background. Did you build a similar tool in another domain? Did you study this problem academically? Even a personal story can establish credibility: “I grew up in a family of truckers, so even though I’m a software engineer by training, I understand the logistics world on a gut level.” Also mention any advisors or early team members who add firepower: “My co-founder was a product lead in this sector for a decade, and my mentor is a former VP at BigCorp who’s guiding our go-to-market.” This reassures investors that you have the right knowledge base around you.

Demonstrate Customer Intimacy: Show that you’re not building in a vacuum. Quote things real prospective customers have said. Discuss how you ran a pilot or built an MVP and what you learned. If you already have letters of intent or early adopters from your network, mention them. For a founder without prior domain tenure, being able to say “I’ve already lined up 3 pilot customers who are eager to try this” can instantly mitigate concerns. It proves you can navigate the market and that your idea has validation from the people who matter (the customers).

Let Your Passion Shine (really, do it): Finally, and at times more importantly, let your conviction come through. VCs meet hundreds of founders a year and know how to read the intangibles. Don’t be afraid to express that you have the necessary grit, determination and might just be crazy enough to do it, because the road ahead will most certainly not be easy. Do you have enough personal/emotional runway to take on the journey of being a venture-backed founder? Don’t assume that investors will read between the lines. Tell them outright.

Betting on the Right Founder for the Right Market

In venture, there is a saying that investors do not invest in ideas. They invest in people. Founder–market fit reflects that mindset. It is about a founder’s unique alignment with the problem they are solving, through their insight, credibility, and determination. If you have it, lean into it. It becomes your advantage, helping you attract talent, build faster, and gain investor conviction. If you do not, focus on developing it through research, customer discovery, and fast learning.

As you build your company or pitch investors, ask yourself: Why am I uniquely positioned to solve this problem? How am I working to strengthen that position every day? If you can answer with clarity and proof, you will tell a story that stands out. When the right founder meets the right market, great companies are built.

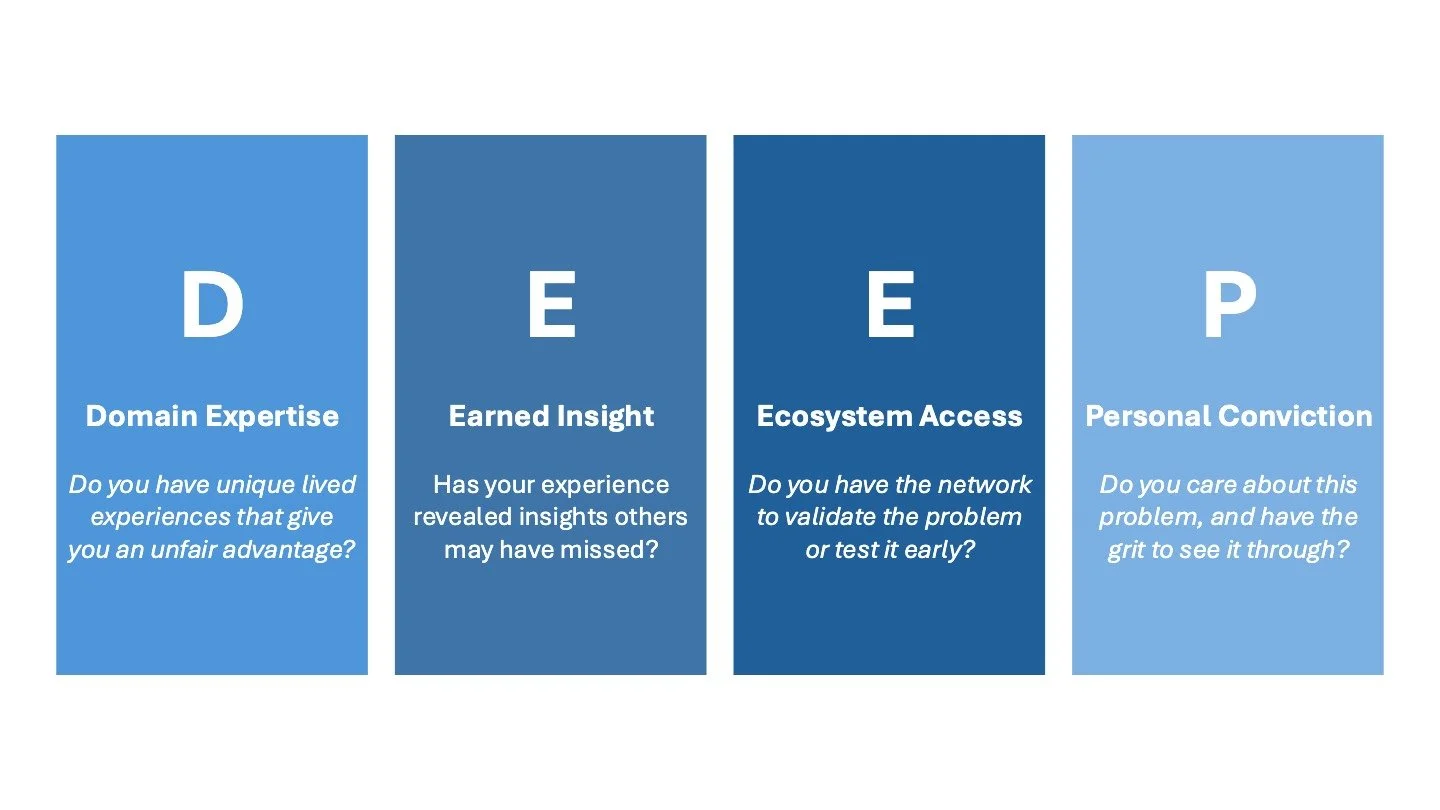

To optimize for deep founder-market fit, we created the DEEP framework to guide how founders build and tell their story:

DEEP Founder-Market Fit Framework